Preliminary Economic Assessment (“PEA”) announced April 2024 included only the Wenot open pit deposit (and not the adjacent Gilt Creek Deposit) and only 1.84 million ounces of the Mineral Resource Estimate for the Omai Project. This 2024 PEA was based on the February 2024 Mineral Resource Estimate (MRE) that has been updated August 2025 with substantial increases. An updated PEA is underway, expected in H1 2026.

Below summarizes the Baseline PEA completed in April 2024. The Company expects the upcoming PEA to include a larger mine plan with the much expanded Wenot open pit MRE and also incorporating the underground Gilt Creek deposit for the first time.

April 2024 PEA established an after-tax NPV5% of $556 million and 19.8% IRR at a $1,950 gold price for the Wenot Project, one of the two gold deposits located on its 100%-owned Omai Property, in Guyana.

The PEA supports an initial open pit mining scenario for production of 1.84 million ounces, averaging 142,000 ounces of gold per year over a 13-year mine life, with peak year production of 184,000 ounces. By applying the higher spot gold price recently experienced, for example, at $2,200/oz, this supports an after-tax Net Present Value5% (“NPV”) of $777 million, a 24.7% Internal Rate of Return (“IRR”), and a payback period of 3.5 years.

Ellingham, President and CEO comments:

“We are extremely pleased with this first economic assessment for the new Omai that incorporates only our Wenot open pit deposit at this time. This PEA is an important step forward as it converts our successful exploration programs into a baseline production scenario that shows potential for robust economic development for Omai to once again become a large-scale gold producer, supported by the many benefits of a brownfields project including good road access, a nearby skilled workforce and the strong support of government for re-development.”

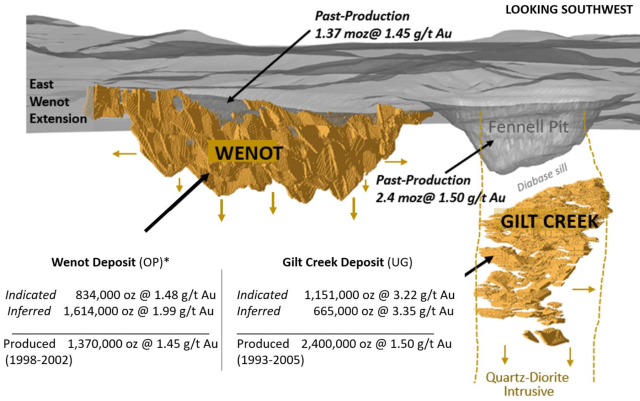

"We have not included the adjacent Gilt Creek Deposit in this PEA economics at this time, however we are confident that it will contribute to an overall future mine plan. Since Gilt Creek would be an underground mine, albeit not overly deep with the top only 300m below surface, it would have required significant additional engineering, time and cost, and our priority was to establish a baseline valuation for our shareholders. We have fast-tracked the advancement of this project over the past two years and are pleased to deliver these tangible results.”

Highlights for Wenot Open Pit

- After-tax NPV5% of $556 million and after-tax IRR of 19.8% based on $1,950/oz gold with a sensitivity case at $2,200/oz gold giving an after-tax NPV5% of $777 million and IRR of 24.7%

- Low initial capital (“Capex”) of $375 million and sustaining capital of $172 million over life-of-mine

- Projected average gold production of 142,000 oz per year over a 13-year mine lifeAfter-tax payback of 4.3 years at base case $1,950/oz gold (3.5 years at $2,200/oz gold)

- Low average cash operating costs of $916/oz gold and lower than industry average all-in sustaining costs of only $1,009/oz

- Cumulative cash flow of $1.07 billion after-tax over 13 years on base case assumptions

- Total payable gold production of 1.84 million ounces (representing only 42% of the property Mineral Resource Estimate)

- Robust average head grade of 1.51 g/t Au and 92.5% process recovery

- Average strip ratio for the open pit life-of-mine estimated at 7.8:1

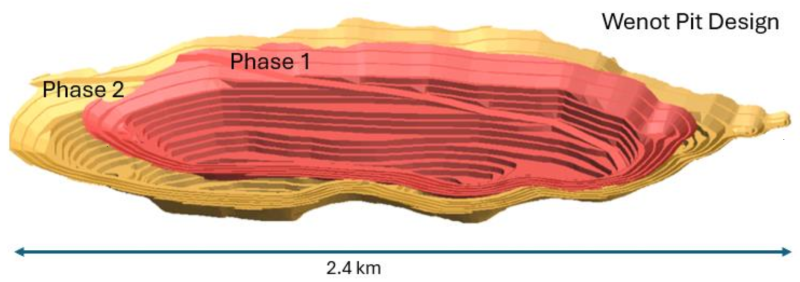

3D Model of the Wenot Open Pit

This PEA establishes the potential for a single “superpit” for the Wenot deposit. Management further believes that Omai holds exceptional potential to both expand the mine plan and boost the economics as follows:

- At Wenot, there are gold zones identified along strike and at depth within and along strike of gold zones, both within and outside the designed PEA pit, that once drilled management believes with positively impact both the Mineral Resources and economics of the Wenot open pit shell;

- By completing engineering studies and incorporating the adjacent Gilt Creek Deposit that hosts very wide and extensive gold zones and a Mineral Resource Estimate of 1.8 million ounces (⅔ as Indicated MRE), the Omai mine plan could potentially expand to a 20+ year mine life; and

- By advancing work on two high-grade near-surface zones, there is potential for higher grade process plant feed for the first few years that would boost economics considerably, reduce the payback period and increase IRR.

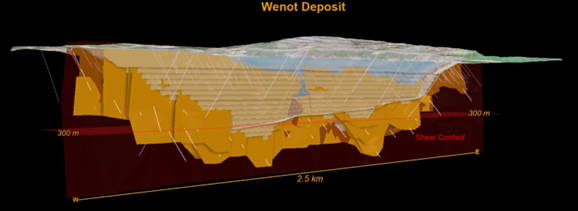

The PEA is based on the Wenot Deposit, with an Indicated MRE of 834,000 ounces averaging 1.48 g/t Au and an Inferred MRE of 1,614,000 ounces averaging 1.99 g/t Au. The pit design used in the PEA does not include a further 58,600 oz of Indicated Mineral Resources and 456,900 oz of Inferred Mineral Resources, which represents approximately 21% of the total Wenot MRE ounces (Figure 1). These excluded MRE ounces are either hosted within multiple, narrow veins that are isolated zones at depth that result in a high strip ratio. However, it is expected that at least a portion of this currently excluded Mineral Resource could be incorporated in future economic scenarios upon further drilling.

Figure 1. Wenot Deposit Showing Pit Design and Mineral Resources Outside Pit

The PEA sets the stage for Omai to advance engineering and permitting initiatives toward a Preliminary Feasibility Study (“PFS”). With these goals in mind, we are anxious to continue our work advancing the Omai Project in 2024.

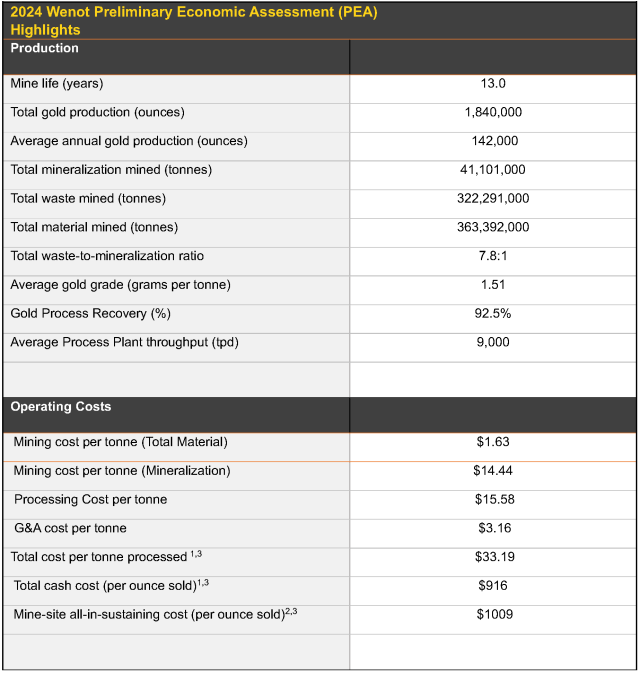

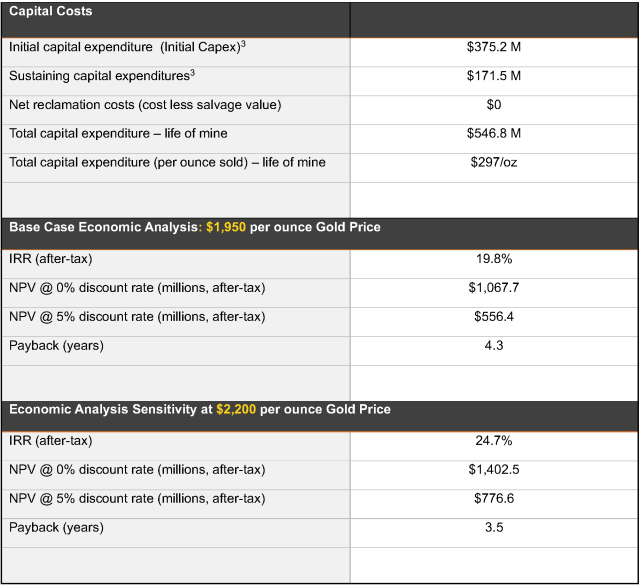

Financial and operating metrics from the PEA are presented in Table 1 below.

Note: The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Table 1. Financial and Operating Metrics from the Preliminary Economic Assessment

- Total cash costs include mining, processing, surface infrastructures, transport, G&A and royalty costs.

- All-in sustaining cost (“AISC”) includes total cash costs, sustaining capital expenses to support the on-going operations, and closure/reclamation.

- Non-IFRS financial performance measures with no standardized definition under IFRS. Refer to the note at the end of this press release.

Financial Analysis and Sensitivities

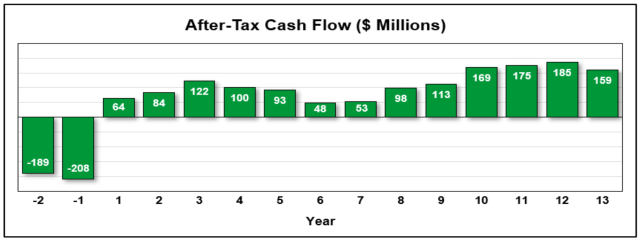

The Project generates cumulative after-tax free cash flow of $1,067 million and average annual free cash flow of $112.5 million over the 13-year producing mine life.

Figure 2. After-tax Cash Flow over Life-of-Mine

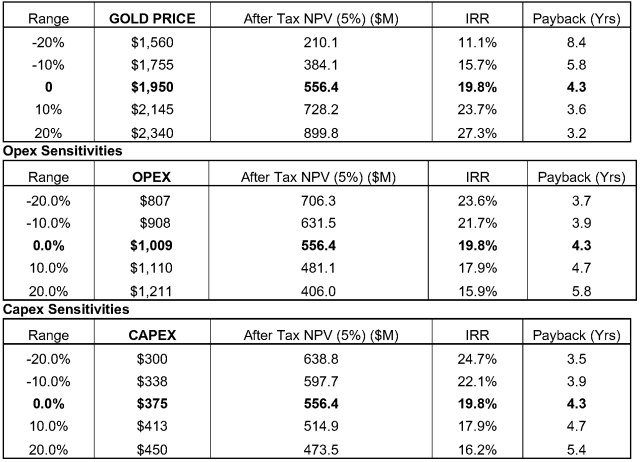

The PEA financial analysis is significantly influenced by gold price, operating costs and capital costs as shown in Table 2. For example, at the base case gold price of US$1,950/oz, the Wenot Project generates after-tax NPV of $556.4 million using a 5% discount rate with an after-tax IRR of 19.8%. However, a 10% sensitivity increase to the base case gold price to $2,145/oz, results in an after-tax NPV of $728.2 million and an after-tax IRR of 23.7% with a payback period of 3.6 years from the commencement of production.

Table 2. PEA Sensitivities to Gold Price, Operating Costs (Opex) and Capital Costs (Capex)

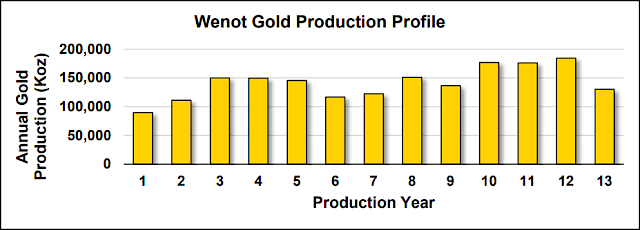

Gold Production

Annual production over the life-of-mine from the Wenot pit is expected to average 142,000 ounces of gold with a peak year production of 184,000 ounces, for total payable gold production of 1,840,000 ounces.

Figure 2. Wenot Production Profile

Low Capital Costs

The initial capital costs are estimated at $375.2 million, with life-of-mine sustaining costs estimated at $172 million. Contingencies of $54 million and $18 million are included in initial and sustaining capital costs, respectively. These estimates were based on current costs and quotes received from potential local vendors with other estimates based on references and experience from similar operations.

The main components of the $375.2 million initial capital costs include: $100 million for the processing plant equipment and buildings plus $75 million indirect costs to construct the process plant, $46 million for mining equipment and surface preparation, $45 million for surface civil and infrastructure, $33 million for capitalized pre-stripping, $20 million for owner’s costs, and $54 million contingency.

The main components of the $172 million sustaining capital include: $139 million for mining equipment, $9 million for tailings and water treatment, $6 million for process plant equipment, and $18 million contingency.

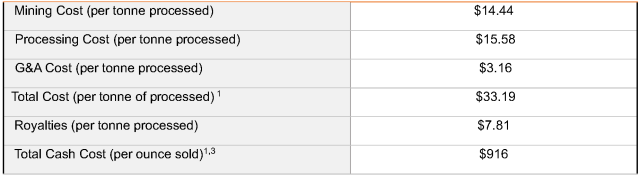

Cash Costs

Total cash cost including royalties is estimated at $41.00 per tonne processed or $916/oz of payable gold. The all-in-sustaining cost estimated at $1,009/oz of payable gold, are much lower than industry average. Operating cost estimates were developed using vendor quotes and knowledge of similar operations with productivities being derived from benchmarking and industry practices.

Table 3. Total Cash Costs

The PEA is based only on the Wenot Open Pit Deposit and excludes the adjacent Gilt Creek Deposit. Management believes that the Gilt Creek Deposit, which would require underground mining, is sufficiently attractive to be integrated into a larger mine plan, however, to accelerate and simplify this current PEA, it was excluded.

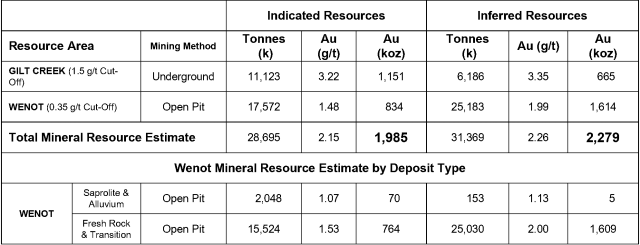

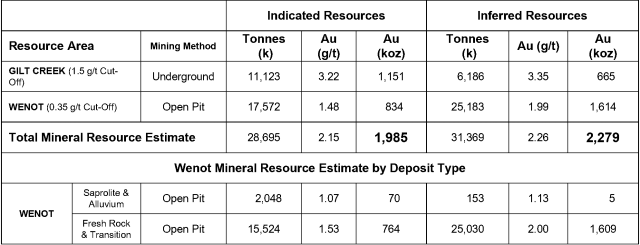

On February 8, 2024, the Company announced an updated Mineral Resource Estimate (“MRE”) for the Omai Property in Guyana (Wenot and Gilt Creek Deposits). It details a total Indicated MRE of 1.985 million ounces of gold averaging 2.15 g/t Au and an Inferred MRE of 2.279 million ounces averaging 2.26 g/t Au.

Figure 4. 3-D Model of Wenot and Gilt Creek Deposits, Omai Gold Property, Guyana

The Mineral Resource Estimates for Omai are presented in Table 4. Notes accompanying the 2024 MRE are shown below the table, summarizing the economic and technical assumptions.

Table 4. 2024 (January) Mineral Resource Estimates

Notes to Accompany the 2024 Mineral Resource Estimate:

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could potentially be upgraded to an Indicated Mineral Resource with continued exploration.

- The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

- Wenot wireframe constrained gold assays were composited to 1.5 metre lengths and subsequently capped between 10 to 25 g/t. Gilt Creek Wireframe constrained gold assays were composited to 1.0 metre lengths and subsequently capped between 12 to 40 g/t.

- The Wenot Mineral Resource Estimate incorporates 9,840 assay results from 603 diamond drill holes totalling 87,323 m within the mineralized wireframes.The Gilt Creek Mineral Resource Estimate incorporates 7,056 assay results from 46 diamond drill holes totalling 27,997 m within the mineralized wireframes

- Grade estimation was undertaken with ID3interpolation.

- Wenot wireframe constrained bulk density was determined from 30 site visit samples. Gilt wireframe constrained bulk density was determined from 28 site visit samples.

- Wenot gold process recoveries used were 92% for Alluvium/Saprolite and 92% for Transition/Fresh Rock. Gilt Creek gold process recovery used was 92%

- The gold price used was US$1,850/oz

- Wenot US$ open pit operating costs used were $2.50/t for mineralized material mining, $1.75/t for waste mining, $10/t for Alluvium/Saprolite processing, $14/t for Transition/Fresh Rock processing and $2.50/t G&A. Gilt Creek US$ underground operating costs used were $60/t for mining, $15/t for processing and $7/t G&A.

- At Gilt Creek, MRE blocks were reviewed for grade and geometric continuity. Isolated/orphaned and single block width strings of blocks were removed in order to only report Mineral Resources with a reasonable prospect of economic extraction.

- Wenot pit slopes were 45o.

Mining

The Project area consists of subdued topography. The area, topography, and climate are amenable to the conventional open pit mining operations proposed for the Project, similar to historical operations. No underground mining is planned at this stage although the potential for development of underground mining of the Gilt Creek Deposit will be evaluated in the future.

The Wenot mining operations will encompass a single large open pit with 55° hard rock inter ramp slopes and 30° saprolite slopes that will be mined with conventional mining equipment in two pushback phases. In order to improve mining selectivity and reduce dilution, two different bench heights and sets of mining equipment will be used. Mineralization will be mined using a 5 m high bench height with 150 mm diameter blast hole drills, and a fleet consisting of 5 m³ bucket excavators and 35 t rigid body haul trucks. Waste rock and saprolite will be mined on 10 m high benches using 200 mm diameter blast hole drills, 22 m³ bucket hydraulic excavators, and 177 t haul trucks. Major pieces of mining equipment will be purchased via a lease financing agreement. Various support equipment will be required, such as dozers, graders, water trucks, and light vehicles for maintenance, personnel transport and mine supervision. The surficial saprolite cover, which is anticipated to be free digging and will not require blasting, is up to 60m thick forming the upper part of the 440 m deep open pit.

The open pit mine will have a mineralization production rate that averages 9,000 tpd over a 13-year mine life. A total of 322.3 Mt of waste rock is planned to be mined, with 2.6 Mt of mineralization in saprolite and 38.5 Mt of mineralization in fresh rock, for a total strip ratio of 7.8:1, at an average grade of 1.51 g/t Au containing 1.99 Moz Au. Total material mined will peak at 110,000 tpd.

Mineralization may be delivered either to the primary crusher or placed into a nearby stockpile. Waste rock is either taken to a waste storage facility or used in tailings dam embankment construction.

Figure 5. Wenot Open Pit Design (Two Phases)

Metallurgy & Processing

An average of 9,000 tpd of gold mineralized material will be treated in the Omai process plant. The process plant will consist of a semi-autogenous grinding mill in closed circuit with a pebble crusher and ball mill in a closed circuit with cyclones (SABC circuit). Primary crushing will consist of a gyratory crusher for hard run-of-mine (“ROM”) feed. A gravity circuit, which precedes leaching will recover coarse gold from the cyclone underflow, while the cyclone overflow is thickened and treated in a multi-tank carbon-in-leach (“CIL”) or carbon-in-pulp (“CIP”) circuit. Gold will be stripped from the loaded carbon, concentrated by electrowinning and recovered as gold bars in a gold room.

The Omai Gold process plant will be designed to be a compact facility with attached grinding media and reagent reception. The process plant facilities will include a laboratory, a mill maintenance workshop, and safety, personal services and management offices.

Metallurgical Data

The anticipated metallurgical performance for processing the Omai Mineral Resources has a dual base of verification: (i) A comprehensive test program by Lakefield Research (now SGS Canada) that was completed in 1990 on drill core representing seven mineralized zones, and (ii) The processing of 80 million tonnes of mineralized material over 12 years by Omai Gold Mines Limited (OGML) from the Fennel and Wenot pits as well as alluvial zones.

During operations from 1993 to 2005, the hard rock ROM feed was crushed in a gyratory crusher and ground by a combination of SAG and ball mills (a SABC designation). Soft mineralized material was blended by a backhoe into the crushed hard rock feed. A combination of gravity-based methods including spiral, Nelson centrifuge and tabling was employed to recover free gold. Gold leaching was conventional with a mild concentration of process reagents, air-sparged leaching followed by CIP gold recovery, stripping from the carbon, electrowinning and electric furnace refining. The historical gold recovery ranged from 92% to 94%.

Metallurgical testing at Lakefield included grinding tests indicating that the Bond Work Index was very high for the hard-rock composites at 19 to 25 KWh/t. As anticipated, the Work Index was very low (~6 KWh/t) for saprolite. Gravity concentration was examined for diorite and saprolite composites and a substantial proportion of gold (~30%) was recovered. A series of standard, 48-hour leach tests were performed on each composite, with the effect of pre-grinding of the samples to up to 90% passing -200 mesh. The results indicated a high gold extraction, from 92% to 97% on the hard rock samples, with only a small effect due to grind size.

Carbon-in-pulp (CIP) testing, representing the recovery of the extracted gold liberated as a process reagent-complex in leaching, was also tested. The recovery of gold to carbon was high for all composites. Flocculation and and thickening tests indicated that reasonable performance could be anticipated in pre-leach thickening which is a key parameter when processing soft, saprolitic feeds.

While the processing history can be used as a new Omai process design basis, test-based options for process upgrading will be considered for crushing-grinding, gravity concentration, gold leaching and recovery (CIL vs. CIP). Since crushing-grinding is the most energy intensive stage, lower energy intensity options including a second stage crushing and high pressure grinding rolls (HPGR’s) will be considered to address both cost and sustainability factors.

Access & Infrastructure

The Omai Project is located approximately 165 km south of Guyana’s capital city of Georgetown and is accessible via a major road that connects Georgetown to Brazil, roughly 350 km south of the Project. This road is paved for the first 90 km to the town of Linden (population ~45,000). Linden is the second largest city in Guyana and was established for bauxite mining. When Omai was in production roughly 90% of the workforce lived in Linden, and it is expected to again be a source from much of the Omai workforce. The road from Linden is currently being widened and paved. It is expected that by year end 2024, there will be a paved road from Georgetown, via Linden, to within 8 km of the Omai Project. The Omai Mine road extends to the east bank of the Essequibo River where a public ferry takes passengers and vehicles across the river on a regular basis.

The Omai site is mostly cleared of forest and has an extensive network of dirt roads providing access to most areas of the Property. The site includes a number of large warehouses remaining from the mining days. The Omai camp consists of two large warehouses that have been repurposed as offices, accommodations, drill core logging facilities and drill core storage, and workshop. Two bunkies provide additional housing, with the camp currently having accommodations for 60 workers.

The mining and processing infrastructure will be located at the Omai site. The Project will require construction of the following infrastructure: 9,000 tpd process plant, offices, truck shop and warehouse, new camp accommodation, surface water management facility, service and haulage roads and initial tailings management facility. An existing airstrip will be used for emergencies and time sensitive transport.

Tailings and Water Management

The tailings storage plan will take advantage of existing facilities and features on the Omai Property, including the existing 350-acre tailings facility and the dewatered Fennel mined-out open pit. Tailings decant will be recycled to the process plant with the excess water treated for discharge. Based on historical (OGML) evidence, the natural degradation of residual process reagents will facilitate the meeting of strict discharge criteria, and only treatment for suspended solids removal will be required.

Workforce

During the construction of the mine, the workforce is estimated to consist of approximately 250 people for an 18-month period, this is in addition to employees who would be required for open pit pre-stripping operations in the 12 months leading up to the production phase of the mine life. During production from the Wenot open pit, the average number of employees at the mine and process plant is estimated at 439 people. The schedule will be two 12-hour shifts per day for 7 days a week.

Next Steps

The positive results of the PEA warrant advancing the Project to the next study stages. Work programs, recommended to advance the Project to Pre-Feasibility Study level, include:

- Infill drilling of gaps in projected gold zones that could potentially reduce waste rock and increase mineralized material within the Wenot designed PEA pit, focusing on the southern side of the Deposit.

- Drilling to convert Inferred Mineral Resources to Indicated.

- Drilling near-surface areas to improve the process plant feed grade in the first two years of mine life.

- Conduct metallurgical studies including crushing-grinding, gravity, leaching and gold recovery tests on bulk samples. Process selection will depend on efficiency of gold recovery and minimizing electricity demand.

- Evaluate gold leaching and recovery variability by Mineral Resource type and identify process options that result in lower energy consumption.

- Detailed geochemical characterization of waste and mineralized rock.

- Detailed geotechnical investigation in the Wenot pit and at various infrastructure sites.

- Develop a water management plan

- Studies of tailings management facility development and/or refurbishment

Qualified Persons

The PEA and Mineral Resource Estimate were completed in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards incorporated by reference in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) (2014) and CIM Estimation Best Practice Guidelines (2019).

The PEA and Mineral Resource Estimate, including verification of the data disclosed, was under the supervision of Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants Inc., who is a Qualified Person (QP) and is independent of Omai Gold for the purposes of NI 43-101, and has reviewed and approved the technical contents of this new release. The NI 43-101 MRE and PEA Technical Report will be published on SEDAR (www.sedarplus.ca) within 45 days from the date of the news release dated April 4, 2024.